My Wild Ride with NVAX

Yesterday, November 30th 2020, I sold my remaining shares of the biotech Novavax Stock at $143.53. I had previously sold shares of the stock in July at $98.29 and then regretted that sell when the stock rose to over $170 a month later. Although I expect the stock to once again rise, I decided that I was satisfied with the gains and did not want to monitor a company that had never brought a vaccine to market in its 33 year history, but received $1.6 billion dollars from the Trump Administration’s shady Operation Warp Speed.

In 2018, fresh from a divorce and having to meet new financial responsibilities of child support and thinking ahead about my son’s college fund, I opened an account with Robinhood. After all, the trading app allowed me to open an account with next to no money, unlike my experience with Vanguard with which I needed a base $3k to start investing. So I needed to generate more money and felt it was time to learn about the stock market beyond the safety of Vanguard indices.

Amongst my most speculative investments was Novavax as I know nothing about biotech, but the stock was a penny stock and I figured, why not take a small gamble. Of course, I considered the company’s long history dating back to 1995 and looked at the rise and falls of the stock. I thought to myself – it’s been around a long time, it has 500 employees, I’ll buy over hundred shares at an average of .56 cents and see what happens. Again, I was new to investing and did not have substantial funds to gamble with so I only buy small amounts, hoping that little by little, I can buy more.

On May 10th 2019, NVAX had a 1 for 20 reverse split, so for each 20 shares of NVAX that I owned pre-split, suddenly became 1. I watched my 120 shares that I had spent $72.21 become 10 stocks (yes not a 1 to 20 and I don’t understand this). Although the dollar amount remained the same, I hated seeing my over a hundred shares become 10. I was so annoyed with the stock, but oh well, nothing to do but let it sit. (The math here doesn’t add up, according to my Robinhood history, I bought 100 shares at .62 cents and then 20 shares at .51 cents and then those 120 shares became 10 following the reverse split. However, the dollar amounts below are correct.)

In the end, I spent $72.21 and sold for $1344.84 for at total gain of $1272.89. Now, I’ll take that gain and buy perhaps Apple or Google or Amazon – a stock that I expect will be around for at least ten years – this is my friend Greg’s advice – buy shares of companies that will stick around. (I’ve already bought Tesla and have only gained, but keep expecting that to entirely disappear at any moment.)

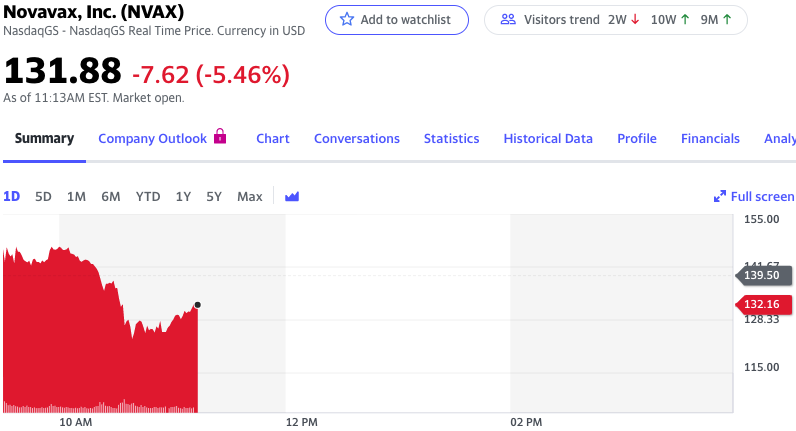

I understand that I’ll never become wealthy at this rate of playing it safe, but I elected to not be greedy and instead to be happy with this gamble, while walking away from Operation Warp Speed nonsense. By the way, yesterday, I sold NVAX at $143.53 and today it is at $125.32; after today, I’m not looking at this stock again. After spending way too much time looking at stocks over the last two years, I’m ready to stop speculating, hang up my dreams of getting rich quick and just invest in relatively safe companies, while also getting back to more meaningful use of my time.

My take away: It took a pandemic and a dirty president to turn my $72 into $1200. The money is dirty and we need to be transparent about how stocks rise and fall to help reign in financial disparity.